Professional Online Tax and Online Notary Services You Can Trust

Helping individuals and businesses maximize refunds, minimize taxes, and stay compliant.

Why Choose Juliette- Authentic Notary LLC Multi-Service for Your Tax Preparation.

Convenience- Preparation is done 100% virtually. No waiting on a Line in a office.

Experienced & Reliable: Over 3 years of experience in tax preparation and consulting.

Personalized Services: Tailored solutions for your unique financial needs.

Stress-Free Filing: We handle the hard part so you don’t have to.

Trusted Professional- We are background check every year.

Credentials -A yearly participant in the IRS Annual Filing Season Program.

E-file- We file both Federal and state.

Services We Offer?

Individual Tax Preparation

Small Business Tax Solutions

Tax Planning & Strategy

IRS Problem Resolution

Bookkeeping Services

Credit Repair- Monthly service

Remote Notary and Mobile Notary Services

Who can we assist with taxes?

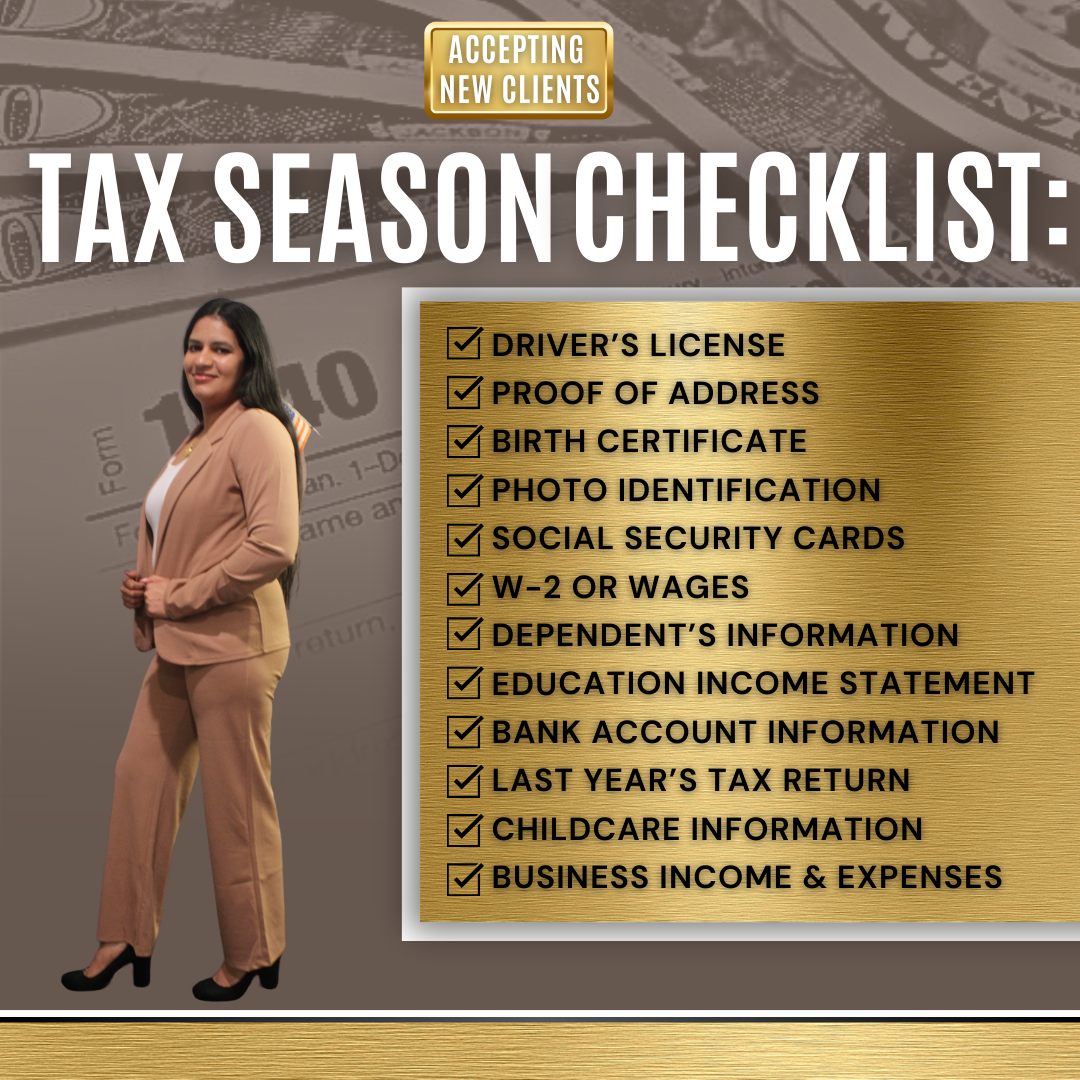

What Do I Need to File My Taxes? Check the list below to be prepared.

Personal Information-Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)SSNs or ITINs for dependents (if applicable)

A valid government-issued ID.

Income Documents-W-2 forms from employers,1099 forms for freelance, contract, or miscellaneous income (1099-NEC, 1099-MISC, 1099-K, etc.)

Investment income statements (1099-INT, 1099-DIV, 1099-B)

Retirement income (1099-R, SSA-1099 for Social Security benefits)

Unemployment income (1099-G)

Rental income documentation

Deductions and Credits forms- Mortgage interest statement (Form 1098),

Student loan interest statement (Form 1098-E),

Tuition payments and education expenses (Form 1098-T),

Childcare expenses (with provider’s tax ID),

Medical expenses and health insurance documentation

Charitable donation receipts.

Expenses for Self-Employed or Business Owners- Business income and expenses, Mileage and vehicle expenses, Home office deduction records

1099-K or 1099-NEC forms for income, Receipts for supplies, advertising, and other business costs

Other Important Documents-Last year’s tax return (for reference),

Records of estimated tax payments made, Any IRS correspondence (if applicable)

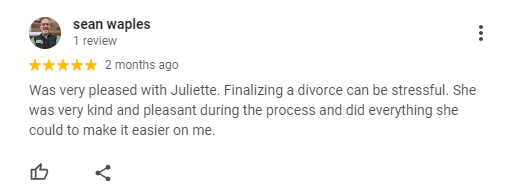

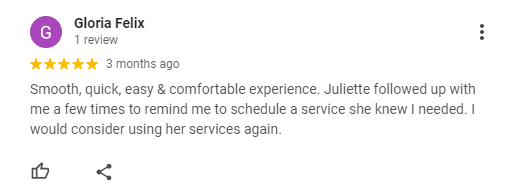

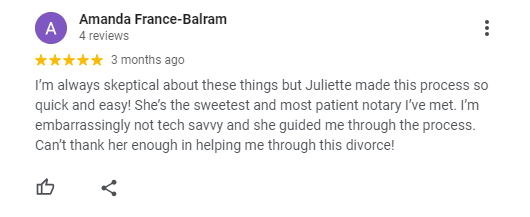

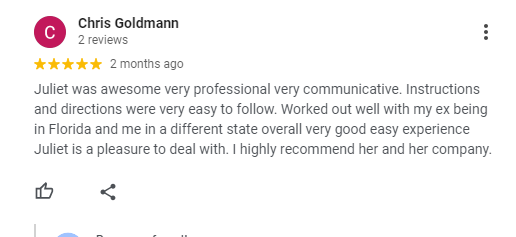

TOP RATED BUSINESS ON GOOGLE

Contact Us | Privacy Policy | Refund Policy

Copyright 2025 - Authentic Notary LLC, All Rights Reserved

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

Everyone's tax situation is different, therefore you would need to be accessed before a quote can be given.

It's not guaranteed your Credit Disputes with our credit repair service would give the outcome you want on the first round.

Facebook

Instagram

LinkedIn

TikTok